|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

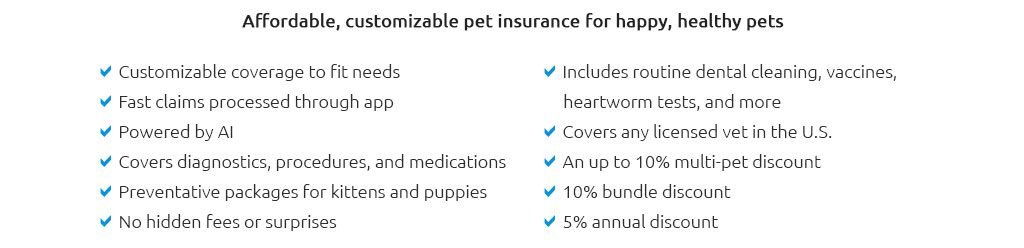

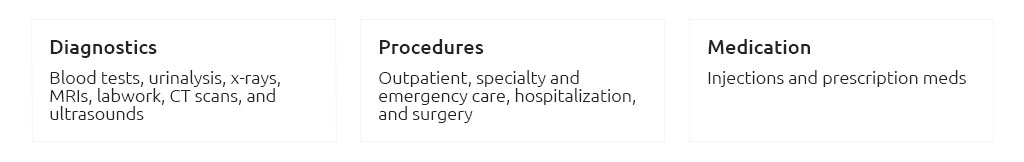

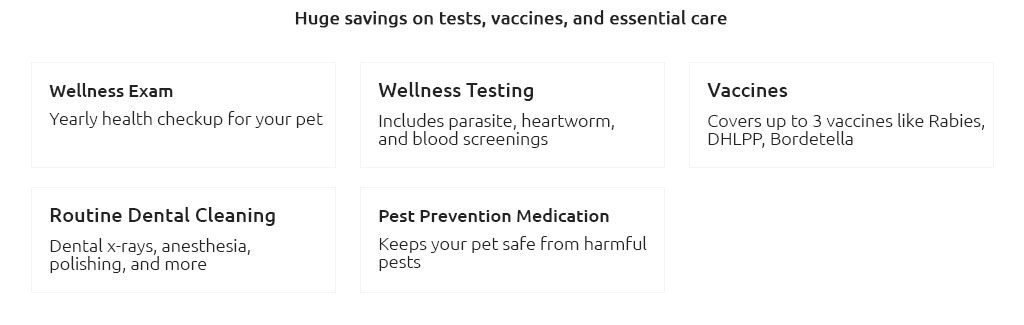

dog insurance wellness plan essentials you can lean onYou want routine vet care to feel manageable. A wellness plan ties checkups, vaccines, and preventives into steady, budgetable support. Fewer surprises. More consistency. What it usually includesThe goal is simple: make everyday care easier to afford without jumping through hoops.

I almost called it full coverage - small correction: it's focused on prevention. Emergencies and illnesses are usually handled by a separate accident-and-illness policy. How it works day to day

Subtle real moment: it's Saturday, your shepherd's booster is due. You tap your phone in the lobby to upload the invoice; a claim number appears before you reach the parking lot, and the reimbursement lands soon after processing. Reliable, low-friction, done. Costs, caps, and reimbursementsMost wellness plans charge a monthly fee and provide an annual allowance or a schedule of benefits. There's often no deductible; instead, each service has a set payout. Keep an eye on annual caps, per-service maximums, and whether exam fees are included. Accessibility matters here - clear tables, straightforward receipts, and quick claim updates signal a trustworthy setup. Who benefits most

Reliability and accessibility cues

What to check before you enroll

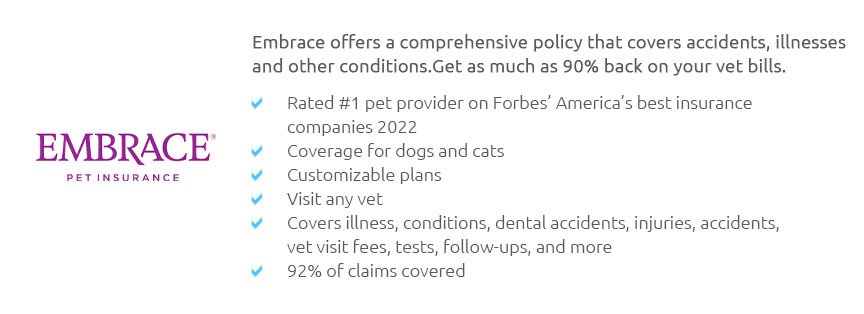

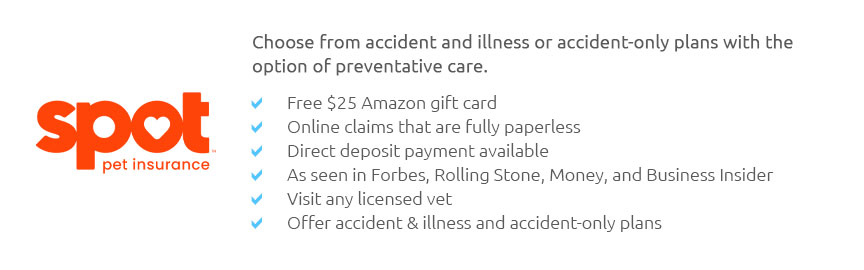

Wellness plan vs a simple savings habitA savings stash is flexible and fee-free. A wellness plan adds structure, reminders, and negotiated payouts for specific services. If you value automation and a clear roadmap to routine care, the plan can keep you on track; if you always budget reliably, savings alone might suffice. A note on trustLook for clarity over hype: published reimbursement schedules, accessible support, and policies that don't hide exclusions in fine print. Reliable coverage earns confidence by paying as described - consistently. Make routine care predictableYour dog thrives on consistency, and so do your finances. If a wellness plan helps you show up for every checkup and preventive, it's doing its job. If not, keep what works for you and your vet; the right choice is the one you can use easily, year after year.

|